You may think you know Chicago Mayor Richard Daley pretty well after reading his recent profile in the New Yorker by Evan Osnos, a former colleague at the Chicago Tribune. But even after more than 20 years in office—and even longer in the media—Daley can still surprise, as I found out during a private lunch with him. The lunch capped the latest Chicago Innovation Awards and provided the winners, profiled here on businessweek.com last fall, a chance to tell their stories individually to the mayor. I was there as one of the judges.

Most of the talk was on innovation, naturally. But as we sat at a large rectangular table in an anteroom in Daley's City Hall office for more than an hour, Daley leaned back in his chair to launch into monologues against the wars in Iraq and Afghanistan and the failure of public schools—Chicago's included—to adequately train kids today in technology, math, and science. Among the education fixes Daley said he's contemplating: a fifth year of high school and elite math and science academies for Chicago's brainiest students. He also praised for-profit schools.

Daley had surprised me just the day before the March 26 luncheon. I had seen him at an event at the CME Group, where he met the media to talk up the jobs and technology that the futures-trading giant has created. In the middle of a standard pro-business speech, Daley seemed to have a Tea Party moment. He scolded government for raising taxes and boosting its payroll, saying such moves put too much burden on the private sector and probably don't really help much anyway. Later, I asked him whether his remarks were aimed at President Barack Obama. No, he answered. But he added that the federal stimulus measures had succeeded only in creating jobs in Washington and not in the rest of the nation, where people are still hurting.

At the lunch, Daley seemed most interested in a couple of inventions by firefighters. One helps crews battle high-rise fires by enabling them to attach a pipe to the building's exterior to pump in water from the floor below. The second is essentially a giant shop-vac that quickly sucks away debris to help rescue victims of cave-ins. But he was also intrigued by dot-com startups such as Everyblock.com, Groupon, and Visible Vote. What more could the city do, he asked, to promote more innovation and entrepreneurship? The winners suggested city sponsorship of tech and scientific conferences. Daley, in turn, pushed education as a way to supply employers with the talent they need.

Too many students are graduating high school knowing too little about technology, math, and science, Daley said. Even bright kids come out with too few skills because they get held behind by the rest of the class, he said. Chicago, he said, should have career-tracked schools where nerds wouldn't be ostracized. Daley also related anecdotes about students who scam the system by obtaining Pell Grants to go to community college but then take just one class year after year, spending the rest of their stipends on whatever. (For-profit schools aren't scam-free, as this report in Bloomberg BusinessWeek showed.)

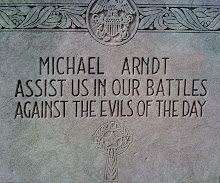

Endless wars are undermining America's competitiveness, too, he said. The reason the country doesn't have enough money for better schools or job retaining, he went on, is that it is spending hundreds of billions a year on war. This isn't what the U.S. should stand for, he added. He also wondered where the public outrage is. Back when his father was Chicago's mayor, he recalled, thousands of people would routinely take to the streets to protest the Vietnam War. Nowadays, he said, there are no demonstrations—people shrug off war and say if enlistees want to go off and risk their lives, well, that's their choice.

He also said he could never talk like that in Washington, or he'd be branded as being politically incorrect.

As we stood in line to help ourselves to the food, I asked Daley what he thought of the New Yorker profile. He said he thought it was fair and that Osnos didn't seem to have it out for him like the local media. Way to go, Evan.