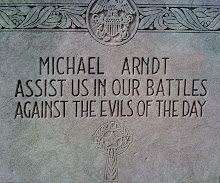

Posted by: Michael Arndt on August 31, 2009

From Venessa Wong, who joined BusinessWeek’s Innovation+Design team in June.

Companies such as Nokia have been cashing in on mobile banking in emerging markets including India, Brazil, and South Africa. The success is in part due to the large number of people in these areas who have mobile phones but do not yet have access to land lines and Internet. Will well-wired American consumers have the same demand for this service?

Diebold believes there is potential. I recently spoke with Keith Lewis, director of marketing for the North Canton (Ohio)-based maker of bank equipment (e.g. ATM) and security products. He said the company plans in September to launch mobile banking services for banks and credit unions in the U.S. Diebold plans to focus on Generation Y generation though it will reach out to other groups. Diebold, which ran into headline-grabbing problems with its voting machines several years ago—it’s since spun off this business—sees mobile banking as one element leading to its next breakthrough: innovating the banking experience.

For the many who have not yet used cell phones and mobile devices for banking, the technology allows consumers to access balance info, transfer funds, and schedule payments and receive alerts among other activities without logging onto the Internet. Users can, for example, send a SMS text message with the letter “B” to their bank and receive a text back with their balance. Diebold is also developing a system for consumers to use their phones to authorize ATM withdrawals which will add a layer of security: when a withdrawal starts, a six-digit PIN is sent to the user’s mobile phone that must be entered during the ATM transaction in order to complete the withdrawal.

At the moment, about 4% of banks and credit unions in the U.S. offer mobile banking, according to research by Aite Group, but Diebold expects the number to grow to about 50% within the next couple of years. Currently, major banks offer mobile web, which allows transactions through the Internet, but the goal is universal adoption, says Lewis. While smart phone penetration has been increasing rapidly, research by the Kelsey Group and ConStat shows it is still less than 20% in the U.S. “This is why having a robust SMS text solution is so critical,” he says. Last year Diebold partnered with ClairMail, which provides a two-way mobile banking platform that supports actionable texting capabilities, mobile web and downloadable applications for mobile phones. Diebold also plans to partner with financial institutions, as a means to help them improve retention rates and reduce call center costs, which average between $6 to $16 per call.

If you use mobile banking in U.S., dear reader, I am curious to hear about the user experience and demands that existing technologies do not yet address.

No comments:

Post a Comment